What kinds of businesses can successfully compete in the market for electric mobility? Many businesses face almost insurmountable barriers to entry as a result of electric vehicle adoption’s slow pace and high initial costs. By defining fundamental key values of electric mobility, customer segments, and central business model patterns, the article provides a framework for the analysis of e-mobility business models.

Thus, the objective is systematic identification of potential e-mobility business model options. According to the viewpoint of all partners included, this makes a difference

to conquer existing hindrances to section. In order to put the theoretical framework into practice and ultimately provide an answer to the opening question, interviews were conducted with a number of providers of infrastructure, energy, and mobility: The most likely business models to succeed in the electric mobility market are those that focus heavily on service or at least one aspect of the so-called “multifunctional utilisation of electric vehicles.”

There is still a shortage of energy and pollution in the environment, despite the rapid development of technology and the gradual rise in public awareness of environmental responsibility. To adjust the requirements

of energy and natural assurance, new energy

vehicles have turned into a significant way. However, the use of new energy vehicles will still result in the emission of CO2.

New energy vehicles have the potential to effectively reduce environmental pollution through the continual advancement of clean power generation technology and processes. The sustainable development of the automobile industry, as well as the conservation of energy and the reduction of emissions in the transportation sector, can be aided by accelerating the industrialization process of new energy vehicles. Additionally, this can improve the innovation capacity of automobile manufacturing enterprises and promote the technological advancement of the automobile industry, both of which are to the benefit of the entire human race.

Tesla’s market value exceeded $600 billion in 2020, up more than seven times. It beat out Toyota to become the largest automobile manufacturer in the world with the highest market value. It had a market value that was greater than that of Exxon Mobil, Royal Dutch Shell, and BP as a whole.

In less than 20 years since its inception in 2003, Tesla has established a benchmark position in the market for electric vehicles and has continuously entered new energy fields like energy storage, power generation, and virtual power plants. Tesla’s distinctive business model is essential to its achievements.

However, the new energy ecology is still in its infancy, and the market for distributed new energy power generation is particularly small. Additionally, energy power enterprises are insufficient to participate in the motivation, and the technical standards and market standards of businesses in various nations are inconsistent. Traditional energy businesses and large-scale new energy developers are Tesla’s real competitors in the field of new energy, not operators of new energy. In the first half of 2021, Tesla ran into a number of issues, including a lack of chips, delivery delays, and owner rights of protection. These issues drew a lot of attention from the market and the general public. Tesla, the leader of the new energy vehicle industry and capital market leader, is far from stable at the moment.

Multiple factors, including the market, finance, capacity, and chip, continue to impede future development. Even though Tesla made a profit every year for the first time in 2020, its net profit was only 721 million dollars, far less than Toyota and Shell, two of the traditional automotive and energy giants. Additionally, from the

point of view of benefit structure, it acquired 1.58 billion US

dollars from selling fossil fuel byproduct credits, far

surpassing its yearly net benefit, and its primary business

was still in a total deficit. Tesla made a $438 million net profit in the first quarter of 2021 that went to common shareholders. In any case, the pay from

selling carbon credits was essentially as high as $518 million, and

the shortfall of the primary business kept on existing. In the future, Tesla must not only maintain its current level of profitability but also enhance the confidence of investors and customers in its main business and improve its profit structure.

The purpose of this paper is to examine the advantages of Tesla’s business model and the ways in which it can promote its development. Through vehicle integration of new energy project development, equipment research, manufacturing, and energy consumption, we will investigate how Tesla can effectively promote cost reduction, quality improvement, and increased efficiency throughout the industrial chain. Tesla currently manufactures all essential components of its products, including power electronic devices, solar tiles, and battery modules. It makes production, operation, and asset management simple, intelligent, and effective by realizing the interconnection, digitalization, and intelligent collaboration of the entire value chain. It creates a coevolving ecological system within the company and a community of future with “value symbiosis” with other major ecosystem components. Tesla constantly increases customer stickiness, attracts more customers, and speeds up product iteration to form a benign ecological cycle thanks to the ecosystem’s strong cohesion and radiation.

The method of Oster Walder et al.’s business model canvas analysis is used in this paper. 1], summarizes the business models that correspond to the various construction subjects and analyzes Tesla’s business models using nine fundamental building blocks. The comparison with the giants of traditional automobile manufacturers provides direction for Tesla’s future sustainable growth. A business model is a conceptual tool that lets a company’s business logic be expressed through a set of elements and their relationships.

Business model

People from all walks of life have engaged in heated debate regarding the business model ever since it was proposed in the 1950s [2]. There is still no consensus on how to comprehend the business model because it is constantly evolving [3]. The

plan of action is primarily used to tackle key

issues in organizations, not entirely set in stone by two

primary variables: innovation and effectiveness [4]. The business model is constantly squeezed as a center by strategy, organization, and system at the same time. Naturally, it is also suggested that the company’s core business model should not be built on speculative or untested predictions about the future [5].

The three main aspects of the business model are as follows:

company logic, the mode of operation of the company, and ways to add value for stakeholders

Business model canvas

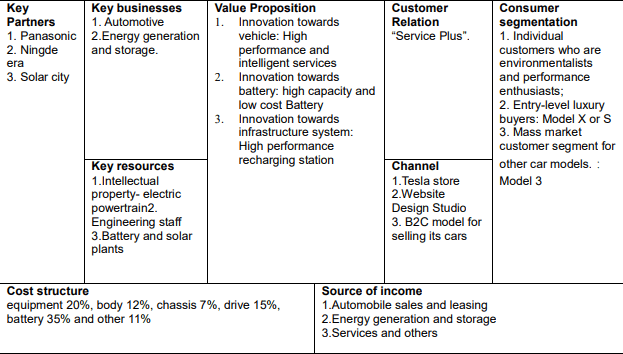

Osterwalde was the one who first suggested the business model canvas. There are four classes of business model canvas: Aspects related to the product, customer interface, infrastructure management, and finances. Additionally, there are a total of nine subcategories in these four categories: Value Propositions, Cost Structure, and Revenue Streams are all components of the customer segmentation, customer relationship, channels, key partners, key activities, and resources. There are nine factors that are connected to each other, but they also express different aspects. The business model canvas is a tool that analyzes the strategic elements that have the greatest impact on the business and provides the company with the goals it needs to achieve [7]. Our primary method for investigating Tesla’s business model is the business model canvas.

Tesla’s business model canvas

A key accomplice is an accomplice that an organization looks for

outside help to amplify benefits. The traditional automobile industry is constrained by oil and engine, whereas the new energy automobile industry is constrained by battery and charging device. The battery is Tesla’s primary power source, and battery life is a competitive advantage for numerous new energy businesses. If the battery life is strong enough, more cars will only use electric power.

Tesla counts Panasonic as one of its most important suppliers of batteries. In addition to the company’s environmental consciousness, Panasonic also excels in battery performance. Ordinary electric vehicles typically make the decision to compromise efficiency in order to improve safety. On the other hand, Panasonic started from a foundation of decades of deep research and development in precision appliances and not only pursued the bold of efficiency but also developed layers of a protection monitoring system and ensured the safety of the battery to ensure efficiency and technology simultaneously. Additionally, Ningde Era is one of Tesla’s primary battery partners. Ningde Era announced at the end of 2019 that it would lead the adoption of the modeless battery pack with the new CTP technology. Other battery manufacturers do not have this technology, but Tesla’s Model 3 series uses the Ningde Era CTP battery. In 2016, Tesla concluded its acquisition of Solar City. Solar cells are the focus of Solar City. Together with Solar City, Tesla intends to establish an integrated, long-term energy company that will eventually encompass energy production, storage, transportation, and consumption. The two businesses when combined will work well together.

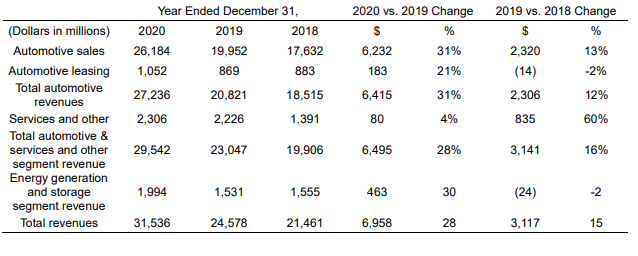

A company’s key businesses are the things it needs to do to keep its business model. Automotive and energy generation and storage are Tesla’s most important businesses, as stated in its annual report. The automotive sector makes up about 85% of the total, while the latter sector makes up about 15%. The car section

incorporates the plan, advancement, fabricating, deals,

also, renting of electric vehicles and deals of car

administrative credits. Non-warranty after-sales vehicle services, retail merchandise, sales of used vehicles, sales by Tesla acquired subsidiaries to third-party customers, and revenue from vehicle insurance are also included in the automotive segment.

Solar energy generation and energy storage products are designed, manufactured, installed, sold, and leased in the energy generation and storage market segment.

Customer segmentation

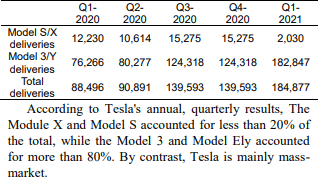

The majority of Tesla’s customers are environmentalists. However, Module X and Model S primarily target wealthy individuals, whereas Model 3 and Model Y primarily target the general public.

Source of income

According to the table, Tesla’s main sources of revenue fall into three categories:

Volume 190 of Advances in Economics, Business, and Management Research covers the energy generation and storage, services, and automotive revenue segments. The Services and other and energy generation and storage segments make up the same percentage of annual revenue, while automotive revenues make up the largest portion.