The establishment of charging infrastructure for xEVs and the expansion of the existing infrastructure for power generation and transmission will be necessary for the xEV rollout. It is not anticipated that xEVs will require a lot of additional power generation. Notwithstanding, huge charging foundation would be expected to be set up especially for transports. While, in the event of transports, charging stations can be situated in the transport terminals, for other vehicle portions, charging stations should be set up in high rises, shopping centers, parking structures, work environments, public structures, and so on.

For charging framework, the point will be to foster this as a financially reasonable business opportunity that draws in confidential venture. The following are some of the steps that the government will need to take to make this activity easier:

Establishing standards for charging equipment; Imposing charging infrastructure requirements in public buildings; Improving building codes to include provisions for charging outlets; Easier access to land for the construction of charging infrastructure; Enabling private retailing of power; Uninterrupted electricity at reasonable prices for xEV recharge; Quick clearances; Conducting pilot projects to evaluate the various charging infrastructure model options.

Future of charging stations

The infrastructure for electric vehicle charging has already been constructed by a few private businesses. Additionally, a robust charging infrastructure may shorten the battery’s charging time. The charging process is complicated by the battery’s capacity. The charging of electric vehicles in plug-in and wireless charging modes is the foundation of numerous research projects. In order to reduce power demand, governments should support the implementation of microgrids, lower-cost electric vehicle charging, and wireless charging in the most important demand areas. The provision of facilities of this kind will result in a decrease in the cost of electric vehicles and an increase in their use, both of which will benefit individuals in terms of paying their power bills and lowering the amount of carbon dioxide released into the environment.

Electric road vehicle battery charging systems and infrastructure

The infrastructure for electric vehicle charging has already been constructed by a few private businesses. Additionally, a robust charging infrastructure may shorten the battery’s charging time. The charging process is complicated by the battery’s capacity. The charging of electric vehicles in plug-in and wireless charging modes is the foundation of numerous research projects. In order to reduce power demand, governments should support the implementation of microgrids, lower-cost electric vehicle charging, and wireless charging in the most important demand areas. The provision of facilities of this kind will result in a decrease in the cost of electric vehicles and an increase in their use, both of which will benefit individuals in terms of paying their power bills and lowering the amount of carbon dioxide released into the environment.

Fast and Smart Chargers

The incorporation of infrastructure for charging electric vehicles is one of the most significant modifications made to the grid in order to facilitate the proliferation of EVs. Due to the relatively long periods that a car is unused and the relatively low power load on the grid during the overnight hours, charging at home has long been an effective option. This option, on the other hand, has significantly higher power requirements due to the importance placed on shortening charging times in the field, as will be discussed in the following section.

All EV chargers require a similar set of power electronics components, despite the fact that the specific individual power requirements of EVs may vary. AC power from the lattice is corrected into a DC source, normally utilizing a diode span. A DC/DC converter, similar to the full bridge converter described in Section 3.2.1, is used to convert the DC power to a voltage that is suitable for the onboard battery. This converter is controlled to produce the required charging profile.

The majority of electric vehicles (EVs) utilize lithium-ion (Li-ion) batteries due to their high energy density, which is advantageous in terms of weight reduction (Young et al., 2013). Most batteries charge in a dual mode, using constant current until a significant portion of their rated voltage is reached before switching to constant voltage while the current is tapered off to bring the battery to full capacity. Variable charging behavior necessitates a smart charger with power, monitoring, and control electronics that can communicate with the vehicle’s onboard battery management system, regardless of the charging profile used.

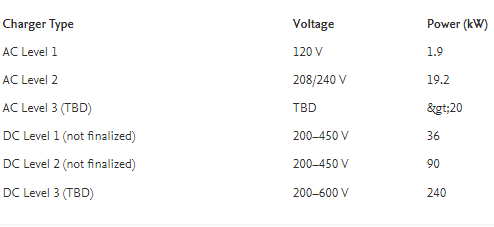

Standards have been ratified to specify certain aspects of EV charging behavior, despite the fact that electric vehicles are still a relatively new technology. The SAE J1772 “SAE Electric Vehicle and Plug-in Hybrid Electric Vehicle Conductive Charge Coupler,” which is published by the Society of Automotive Engineers, is the de facto standard for EV charging in the United States. Table 3.2 provides a summary of SAE J1772’s three EV charger types. AC Level 1 chargers in the United States operate on a standard 120 V AC outlet and, as a result, do not necessitate any modifications to the infrastructure. However, the relatively low power delivery capacity of these chargers results in a lengthy charging time; consequently, AC Level 1 chargers are suitable for extended charges, such as those that take place over the course of the night. Similar to large household appliances like a clothes dryer, AC Level 2 chargers use 208 or 240 V split-phase power. Both AC Level 1 and AC Level 2 chargers require the EV to have an onboard rectifier/converter to charge the battery, and the necessary size and weight requirements for designing onboard chargers limit their power handling capacity. As of the January 2010 revision of SAE J1772, AC Level 2 chargers are limited to 80 A and therefore can supply up to 19.2 kW. Additionally, a Level 3 AC charger with a power output of more than 20 kW has been proposed.

The SAE also made a proposal for DC chargers, which are listed in Table 3.2 but have not yet been standardized. Power conversion is done off-board with these chargers, and DC power is delivered to the electric vehicle without going through the onboard converter. Because the AC/DC conversion is done off-board, the rectifier’s size and weight are less important, allowing the converter to produce more power. These chargers are made for EVs that need to be charged in the field because they can deliver more power. Numerous different variations of the DC charger are available, including the Tesla Supercharger (Tesla Motors, n.d.; CHAdeMO, n.d.)

In the field, quick charging times are desired, which necessitates a significant amount of power delivery. A 20 kWh electric vehicle battery, for instance, would require more than an hour to charge using an AC Level 2 charger and more than 11 hours to charge using an AC Level 1 charger. The same battery could be charged using a 50 kW DC Eaton charger (Eaton Power Corporation, 2013), making on-the-go charging feasible for EV owners.

The market for battery electric vehicles

The charging infrastructure that electric vehicles require to transfer electric energy from the distribution grid to the vehicle battery is the primary focus of this chapter. It discusses the charging infrastructure’s current development, the difficulties encountered during its development, and the ongoing standardization efforts in the field. Semi-fast charging, on the other hand, uses current levels that are higher than those of a typical domestic outlet, typically up to 22 kW, but which could be readily made available in a typical residential or commercial setting. Normal charging uses a power level that is comparable to the standard power outlets that are typically available in residential installations. Higher power levels are used for fast charging, which requires additional infrastructure beyond standard domestic or industrial socket outlets and can be done with either a d.c. or an AC connection between the charging post and the vehicle. A two-part transformer with the primary connected to the network and the secondary installed on the vehicle is used for inductive charging, which is defined as the electromagnetic transfer of energy from the supply network to the vehicle. In the 1990s, General Motors introduced and heavily promoted paddle charging, in which a paddle serves as the primary coil and secondary coils are arranged around a vehicle slot. Because they rely on the electric grid for their energy supply and because the majority of plug-in hybrid vehicles are anticipated to operate in an electric mode, battery-electric and plug-in hybrid automobiles would also require charging infrastructure. In order to develop unified solutions, a number of international standardization committees are working on the issue. These efforts will play a crucial role in encouraging the worldwide use of electric vehicles.

Modeling of battery performance and traction energy

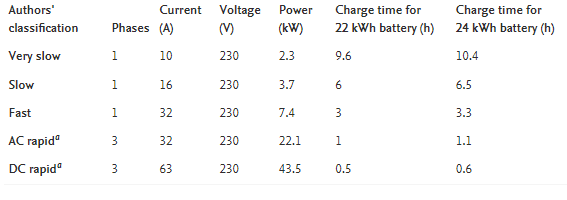

The electric vehicle charging process is the source of contention in the electric vehicle industry. Improvements have been made to the charging infrastructure, resulting in shorter charging times. Until widespread chargers are installed nationwide, EV drivers must be aware of their vehicle’s range when refueling. When going electric, the driver must make a choice about how they plan their trips. Consumers can charge their batteries in a variety of ways, from slow charging to fast charging. Governments have installed many of these, and additional installations are anticipated. A single-phase slow or fast charger can be used domestically to access the supporting infrastructure. At this time, public charging stations offer free access to three-phase rapid chargers as well as single-phase fast chargers. It is used to compute the charging time of various batteries.

Pay attention to the 22 and 24 kWh batteries, which represent the Nissan Leaf BEV and the Renault Zoe BEV, respectively. Tesla has also looked into another option in California, where owners can get a battery-swapping service that takes less than 90 seconds. This innovation will show the public that the industry is confident that this technology will be a big part of private transportation for years to come and will get around major obstacles to vehicle range.

Norway’s electric vehicle situation

The proliferation of EV models on the market is made possible by advancements in EV technologies. As the number of EVs has increased, charging infrastructures have improved in order to construct a sustainable transportation facility in the country. Framework offices that work with typical and quick charging are fundamental for the EV clients, and it should be worked with the entrance at public and private, own home, or high rises. A well-organized charging facility is required for trips over longer distances. Indeed, even EV clients are charging at home and oversee without charging day to day, quick charging is vital choice that they can utilize when required.

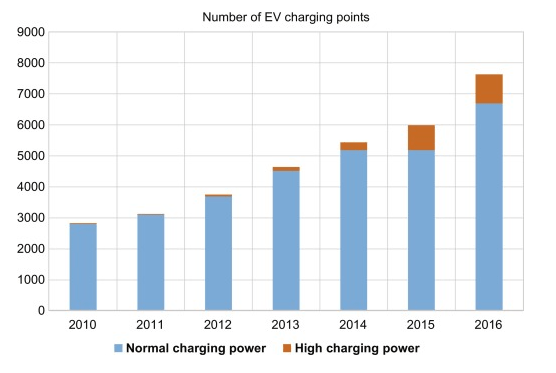

Most public parking spaces offer free normal charging. Due to the e Tesla plan of lifetime free quick charging, the portion of the Tesla clients didn’t pay for quick charging. According to Fearnley, Pfaffenbichler, Figenbaum, & Jellinek (2015), they are also willing to pay a higher price for the service of fast charging, even though it was occasionally free in the past. Norway is home to the most extensive network of EV charging stations in the world. The Norwegian electric vehicle association (NOBIL) maintains a public database of charging station locations. NOBIL is the quality confirmation data set with the data about charging stations, what sort of electrical plug is accessible at the station, access data, pictures, and so on. This database has provided accurate and trustworthy online information that can be accessed by the vehicle’s navigation systems to get directions to the closest charging station. As more charging stations are built in Norway, it will keep growing. According to EAFO (2016), Norway now has 6600 normal charging stations and 900 fast charging stations. As depicted in Fig. 9.6.1, the rapid growth of EVs has resulted in an ongoing expansion of charging infrastructure.

As indicated by European Clean Power for Transport mandate suggestions, there ought to be one public accessible charging point for each 10 electric vehicles by 2020. With an exponential rise in EV use from 22% in 2015 to 30% in 2020, the number of Norwegians using EVs could reach 250,000 by 2020. It demonstrates that by 2020, there ought to be approximately 25,000 public charging stations available. As a result, the Norwegian government has launched a program to finance the installation of at least two multistandard fast charging stations on all major roads in Norway every 50 kilometers by 2017.

The integration of electric vehicles with other distributed resources in smart distribution grids

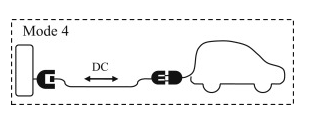

Because the battery charger is now in the charging station itself, DC charging infrastructures are characterized by a high charging power. Since there are fewer constraints in terms of volume and weight, it is possible to increase the electronic converter’s power in this manner. A DC charging infrastructure’s fundamental structure is depicted.

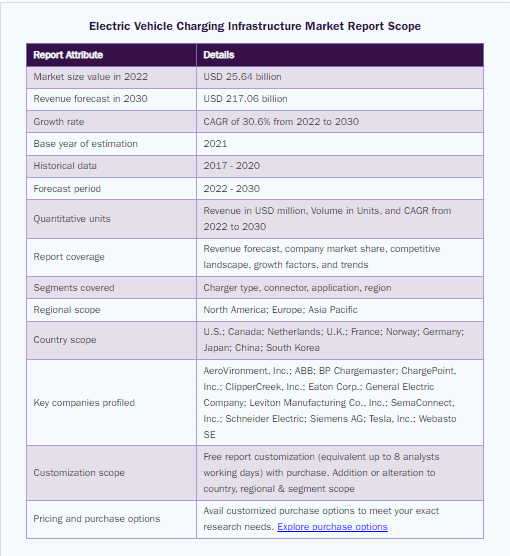

Report Overview

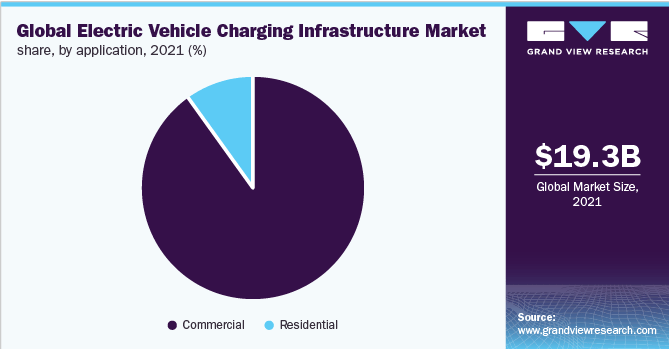

Request a FREE Sample Copy of the Report Overview The global market for electric vehicle charging infrastructure was valued at USD 19.26 billion in 2021 and is anticipated to grow at a CAGR of 30.6% between 2022 and 2030. The report’s summary includes the following sections: Table of Contents, Segmentation, and Methodology. Electric vehicles must be used because of the rising levels of carbon emissions and other harmful gases from transportation. As a result, there is an increasing demand for a charging infrastructure for electric vehicles (EVs) in both commercial and residential settings. In addition, the market expansion is anticipated to be further fueled by the expansion of partnerships among automobile manufacturers for charging facilities that provide a subscription model.

It is anticipated that the way electric vehicle owners use and benefit from applications for electric vehicle charging will change as a result of technological advancements in both software and hardware. Even before the driver plugs their electric vehicle into a charging station, technologies like the Smartcar API and charging networks precisely determine how long it will take for the vehicle to charge.

In addition, green energy is anticipated to play a significant role in both public and private charging facilities for electric vehicles. Carbon emissions are a major concern for EV owners. Companies are rapidly advancing the charging technologies of their electric vehicle charging networks to address these concerns.

When compared to residential areas, commercial settings have a significantly higher market penetration of EV charging equipment. It is anticipated that the increasing use of electric vehicles will lead to an increase in the number of commercial charging stations. Because overnight charging at residential complexes or individual homes would not be sufficient for long-distance journeys, efforts to strengthen the charging infrastructure in commercial spaces would be crucial to encouraging the adoption of EVs.

In addition, public charging infrastructure would make it easier to provide the ultra-fast charging capabilities that are required for journeys over extended distances. However, residential EV chargers can also offer significant growth potential due to their lower cost and increased convenience in comparison to commercial charging stations.

In order to incorporate chargers into the existing infrastructure, EVCI manufacturers are working together with the car rental service. For instance, Eaton announced in January 2020 that it had entered into a partnership with the car rental service provider Green Motion to supply the building with integrated chargers that could store energy. The development of Car2X technology for charging infrastructure is being driven further by investments made by a number of automotive manufacturers, including General Motors, BMW Group, Volkswagen Group, and others.

Several campaigns have been launched to encourage more people to buy electric cars in countries like Canada, India, France, and the Netherlands. However, the global automobile industry is expected to slow down as a result of the COVID-19 outbreak because a number of nations have restricted EV production. The market for electric vehicle charging infrastructure is anticipated to suffer as a result.

EVs are anticipated to continue receiving significant attention as governments around the world focus on overcoming the pandemic with a stronger economy. For example, in the U.S., California is arising areas of strength for with vehicle targets, as most would consider to be normal to have a positive effect post-pandemic and lift the development of the market.

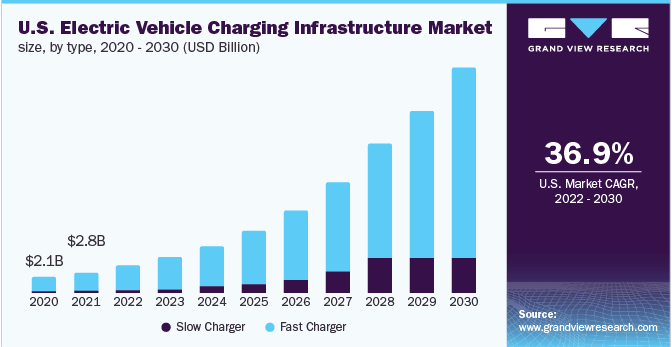

Charger Type Insights

Due to the growing demand for its use in commercial stations, the fast charger segment dominated the market in 2021 and contributed more than 93% of global revenue. Most associations have sent Level 1 DC quick chargers or Level 2 AC charging stations that can completely charge an EV inside 4-6 hours.

In addition, as part of their efforts to promote their electric vehicles, automobile manufacturers are emphasizing the installation of electric vehicle charging stations for their employees. For instance, the addition of one hundred Level 2 EV charging stations to the parking lots of the Detroit facility of General Motors Company has resulted in an increase in employee demand for Chevrolet Volt electric vehicles manufactured by the company.

In 2021, the market was dominated by the slow charger category as a result of government efforts to speed up the implementation of public charging infrastructure, most of which makes use of slow chargers. Additionally, most residential applications that require overnight charging make use of slow chargers.

Additionally, the majority of electric vehicle manufacturers, including General Motors, BMW of America, and Volkswagen Group, offer slow chargers with the purchase of electric vehicles, which is further propelling the segment’s expansion. For instance, when you buy an electric car from General Motors, you get a slow charger.

Report Coverage & Deliverables

Connector Insights

In 2021, the CHAdeMO segment dominated the market and contributed more than 17% of global revenue. This is primarily due to its ease of use and compatibility with the majority of electric vehicles (including BMW, GM, and VW models).

Additionally, because it only requires a single charging port, it provides design flexibility for electric vehicles; CHAdeMO connectors, on the other hand, don’t support AC charging, so they need two charging ports. Additionally, the Japan Electric Vehicle Standard (JEVS) specifies the current CHAdeMO connectors, which can deliver 62.5 kW of DC.

Due to the growing preference of major automakers for the use of CCS connectors in EVs, the CCS segment is anticipated to expand at the highest CAGR over the forecast period. For instance, Tesla announced in July 2019 that a CCS connector would be available for the Model 3 and would likely be compatible with the Model S and Model X in Europe in the near future.

Additionally, there are two distinct types of CCS connectors: CCS Type 1 and CCS Type 2. CCS Type 1 connectors are widely used in the United States, whereas CCS Type 2 connectors are used in Europe. Furthermore, over the forecast period, demand for the CCS segment is anticipated to be driven by support from major automakers and original equipment manufacturers like Daimler AG, Ford Motor Company, General Motors, and Volkswagen Group.

Application Insight

The business portion represented an income portion of 84% in 2021 inferable from the drives and distribution of financing by the states and car makers for growing public EVCI foundation. Because overnight charging or charging at home would not be sufficient for travel over long distances, it is necessary to develop supporting infrastructure in public areas.

In order to install charging stations for electric buses, a number of public transportation agencies are collaborating with automobile manufacturers. This is further propelling the growth. For example, TRAFIKSELSKABET MOVIA consented to an arrangement with Siemens for the establishment of electric transport accusing stations of a hierarchical pantograph for electric transports worked by 45 districts, including the City of Copenhagen and Locale Zealand.

a variety of charger manufacturers, including Efacec; EVE Australia Private Limited; and Tesla, Inc. is working together with contractors to build residential complexes. For instance, in partnership with SemaConnect Inc., the Pend Oreille Public Utility District will open a brand-new EV charging pilot system in October 2020. This charging station will provide visitors to the Newport Administration Building with free access to charge their electric vehicles.

In order to guarantee increased availability and increased vehicle range, manufacturers of vehicle chargers are concentrating on developing residential and commercial EV chargers. Fast-charging stations are being installed by OEMs in conjunction with EV manufacturers, charging network operators, businesses, and utility service providers to enable cost-effective EV charging network deployment and geographical expansion.

Regional Insights

In 2021, Asia-Pacific dominated the market and contributed more than 59% of global revenue. The hub for electric vehicles is China, Japan, and South Korea, all of which are investing heavily in the development of charging infrastructure. For instance, the Chinese government announced in October 2015 that it would make an investment in the installation of EV infrastructure in order to achieve its goal of supporting 5 million EVs on roads by 2020.

In addition, South Korea announced a USD 180.3 million investment to expand the nation’s EV charging infrastructure in an effort to promote environmentally friendly vehicles in the transportation sector. Besides, Japan’s electric charging station outperformed the quantity of gas stations with more than 40,000 charging outlets in 2020

Different European nations have set aggressive focuses for checking fossil fuel byproducts and electric vehicle stock responsibilities by 2020. For instance, the Automated and Electric Vehicles (AEV) Act was enacted by the British government in July 2018. It gives the government new powers to make sure that EVCI on highways and fuel stations grows quickly.

The German National Platform for Electric Mobility was established in October 2014 as an advisory body of the German Government to examine the development of public electric vehicle charging infrastructure and electric mobility. In order to facilitate EV interoperability across the region, other European nations, including France, the United Kingdom, Germany, and Belgium, are also focusing on the development of the infrastructure for EV charging and support.

Key Companies & Market Share Insights

The major players in the market are constantly working on new product innovations and product portfolio enhancements. These players favor partnerships with other EV manufacturers for strategic growth. One of the leading players in the market, ChargePoint, Inc., collaborated with BMW of North America, LLC and Volkswagen of America, Inc. in 2016 to set up approximately 100 DC fast-charging stations on the east and west coasts of the United States. Additionally, ChargePoint Inc. has been implementing a number of strategic initiatives to increase its presence in Europe.

Through mergers and acquisitions (M&A), market participants are also consolidating their market shares. The acquisition of the infrastructure provider Elektromotive Limited and its subsidiary (Charge Your Car) by Chargemaster Plc was made public in 2017. The former intended to expand its customer services and portfolio through this acquisition. Chargemaster Plc, the largest EV charging network in the United Kingdom and the leading supplier of EV chargers, was acquired by BP plc in 2018. Chargemaster Plc has changed its name to BP Chargemaster since the acquisition. BP plc was able to set up a fast and ultra-fast charging network on its forecourts in the UK thanks to the acquisition. In the global market for electric vehicle charging infrastructure, some prominent players include:

- AeroVironment, Inc.

- ABB

- BP Chargemaster

- ChargePoint, Inc.

- ClipperCreek, Inc.

- Eaton Corp.

- General Electric Company

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Schneider Electric

- Siemens AG

- Tesla, Inc.

- Webasto SE